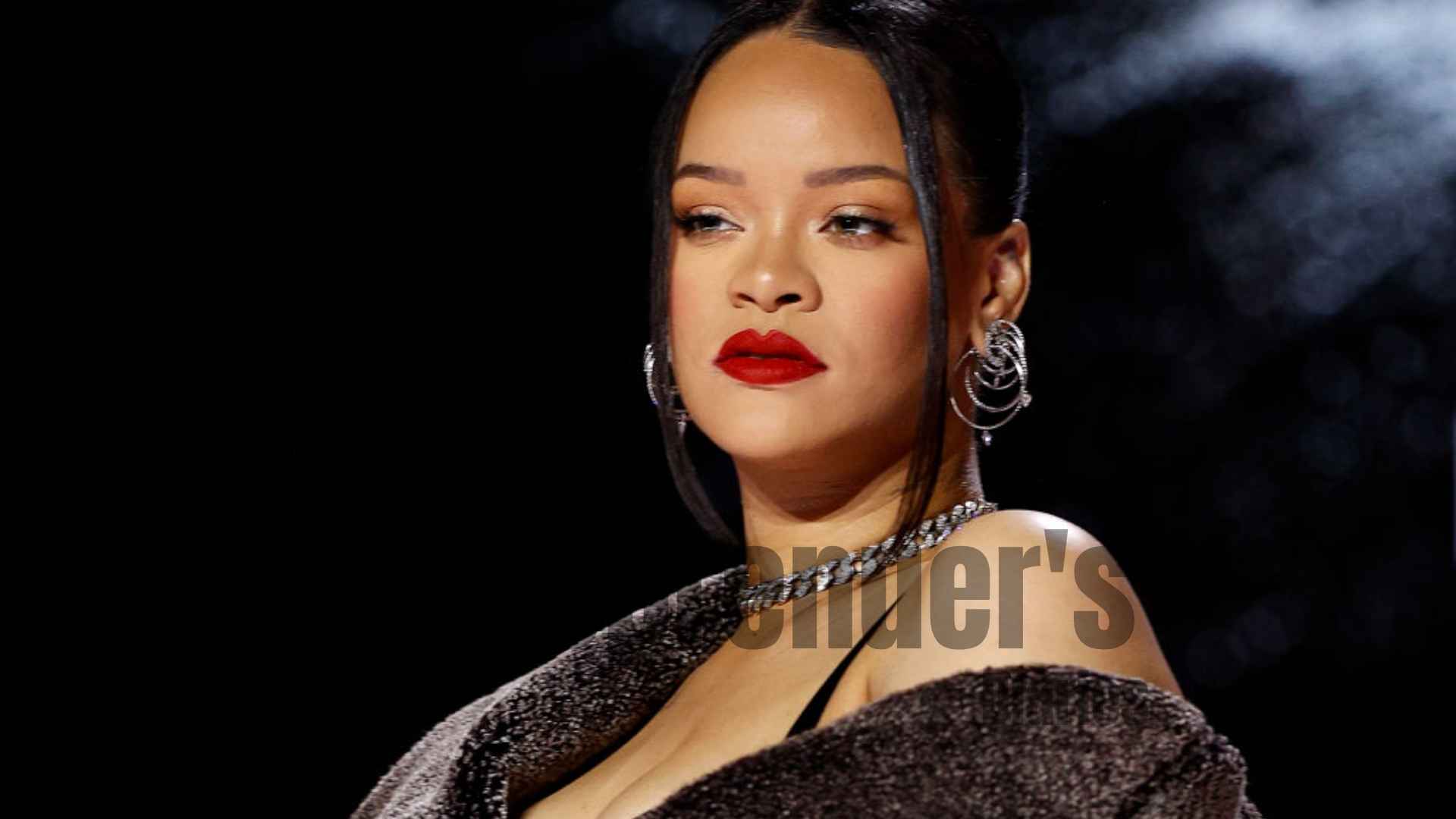

Rihanna hasn’t released an album in nearly nine years, but her voice has never been louder in business. At 36, she stands at the crossroads of culture and commerce not as a passing celebrity brand, but as the architect of a billion-dollar consumer empire that is reshaping how beauty, fashion, and inclusivity intersect.

The Risk That Redefined an Industry

When Fenty Beauty launched in September 2017, it wasn’t built on fragrance hype or celebrity glow. It was built on a gap. Rihanna had been open about the frustration of not finding products that matched her skin tone, and she knew millions of other customers felt the same.

The debut foundation line had 40 shades, expanded to 50. For an industry where “inclusive” often meant token shades added for PR, this was a ground shift. Retailers noticed. Competitors scrambled to expand their own ranges. The first full year saw revenues estimated at $570 million, according to LVMH filings not from limited drops or novelty products, but from sustained, repeatable sales across markets.

Key founder takeaway: Fenty didn’t sell a product. It solved a problem at scale, and made the solution impossible to ignore.

Scaling the Vision

Rihanna’s deal with LVMH was no licensing side hustle. Partnering with the world’s largest luxury group gave her global manufacturing, distribution, and branding power that few independent founders can access. Sephora became Fenty’s launchpad, giving instant reach in key markets from Paris to Dubai to Los Angeles.

But Rihanna didn’t settle into beauty alone. She built a product ladder: Savage X Fenty disrupted lingerie with unretouched campaigns and full-size inclusivity; Fenty Skin and Fenty Hair extended the brand’s lifestyle ecosystem. This was diversification with purpose every extension connected to the core promise of inclusivity and self-expression.

In March 2025, rapper GloRilla became the first ambassador to represent all Fenty verticals. The move wasn’t about celebrity endorsements; it was about a unified brand voice across beauty, lingerie, skin, and hair.

Calculated Expansion

January 2025 saw Fenty Beauty enter John Lewis stores in the UK. Physical retail is a harder play than online, but Rihanna’s team knows the math: prestige positioning in department stores builds brand trust in markets where digital-first beauty brands still fight for legitimacy.

The same month, Fenty launched “You Mist,” a makeup-extending spray promising 12-hour wear and skincare benefits. Rihanna appeared in the campaign with her natural curls, a visual alignment with the authenticity that built her base in the first place.

Key founder takeaway: Expansion without dilution. Every move reinforces the brand’s DNA.

Money, Power, and Structure

Industry estimates place Rihanna’s net worth at $1.4 billion. What’s telling is the revenue mix the bulk comes from Fenty brands, not music. Savage X Fenty has attracted institutional investors like L Catterton, while Fenty Beauty continues to scale under LVMH’s luxury division.

Sources close to the company describe a founder who is present in product development and brand positioning, but trusts operational execution to seasoned executives. It’s a hybrid approach visionary founder at the front, operational backbone behind the curtain that many celebrity-led brands fail to master.

Navigating the Challenges

It hasn’t all been straight-line growth. The ready-to-wear fashion label Fenty under LVMH closed in 2021 after less than two years, a reminder that even a powerhouse brand can misfire if timing and category fit aren’t right. Rihanna treated the closure not as a failure but as a course correction, focusing resources on the beauty and lingerie arms where consumer loyalty was strongest.

Competition is also rising. Legacy beauty houses have caught up on shade ranges, while fast-fashion and DTC brands compete aggressively in lingerie. Rihanna’s edge remains her cultural currency she markets products not through seasonal ads, but through moments that trend for weeks.

A Founder’s Playbook

Rihanna’s rise as a founder is built on four levers:

- Solve a market-wide pain point inclusivity as a core product feature, not a campaign.

- Lock in distribution partners that can scale globally without diluting brand control.

- Diversify deliberately into adjacent verticals that serve the same customer.

- Control the cultural conversation so competitors are always reacting to you.

She didn’t invent inclusivity in beauty. She operationalized it into a profitable, defensible business model.

The Cultural Dividend

Rihanna’s empire is more than revenue streams. Fenty has become a shorthand for modern luxury that’s accessible, representative, and globally relevant. When she steps into a campaign, it’s not just celebrity sparkle it’s founder credibility, and consumers can tell the difference.

Nine years without an album might look like a gap to music fans, but to anyone studying her trajectory, it’s been a masterclass in brand building. She turned cultural capital into equity, equity into market share, and market share into enduring enterprise value.

And she’s still expanding. If history is any guide, Rihanna won’t rush the next product drop just as she hasn’t rushed the next album. She’ll wait until it’s right. That patience is the same edge that built her business in the first place.

Connect With Us On Social Media [ Facebook | Instagram | Twitter | LinkedIn ] To Get Real-Time Updates On The Market. Entrepreneurs Diaries Is Now Available On Telegram. Join Our Telegram Channel To Get Instant Updates.

Ethan is a Lisbon-based leadership strategist who helps remote-first startups scale through systems, team clarity, and async culture.