Ryan Cohen As Board Chair, Sending Shares Surging Anew GameStop Taps Billionaire Investor

HEADLINE: Ryan Cohen, the billiard investor who has tried to revamp and restructure the distressful brick and mortar industry, was chosen to lead the company’s board just three months after joining the Board and has again fueled bustle between investors who have ploughed into the shares in Gamestop at unprecedented levels

FACTS CLAVE:

GameStop announced that on Thursday, after the company’s annual shareholder assembly held June 9, it will elect the 35-year-old Cohen, the former CEO and founder of the Chewy online booming pet deliveries store, as its Chairman.

Larry Cheng, a co-founder and Managing Partner of Volition Capital, and Kraft Heinz Senior Vice President Yang Xu, were also appointed as additional members of the boarder of Grapevine, Texas. The company also has venture capital veterans.

The announcement on Thursday adds to a number of recent board and management shake-ups on GameStop, as Cohen works together with two other executive members, including Chewy Executive Alan Attal and Hestia Capital Founder, Kurt Wolf, a company-wide activist shareholder who blasted former directors on GameStop Kurt Wolf, as well as Cohen’s

Thursday the company also announced that its managers will pay GameStop shares only, in contrast to the majority of managers who received cash last year for up to $140,000. (representing a slight majority of total compensation)

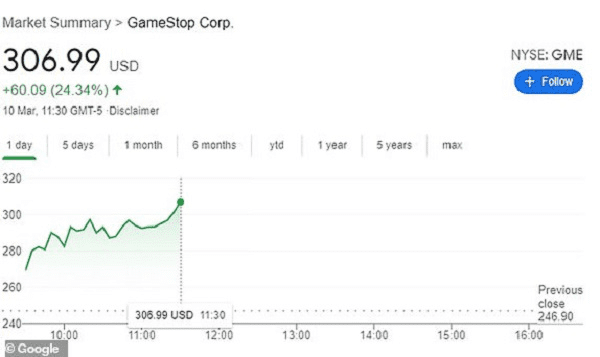

The share of GameStop, which this year saw an incredible 90%, rose by 6% in pre-market trading after the announcement

THREAT NEWS

1,9 billion dollars. 1 million. According to news, as soon as Wednesday comes close, this is how much Cohen, who owns approximately 13% of GameStop shares.

American stocks are increasing after inflation figures have been released.

Commenting on US markets, Chris Beauchamp, Chief Market Analyst, IG: American stocks have progressed since the release of monthly inflation figures showing price increases, but not a modest pace, calming fears of a sudden price spike. The news contributed to ensuring early gains for US stocks, but Tech remains highly sensitive to the idea of higher rates and yields as well as to digesting all its extraordinarily bullish gains from the Tuesday meeting for as in Gamestop.

Again, expectations are at odds with reality, as the market evidently decides that, once inflation begins to rise at an even faster rate, trade across asset classes is forced to move. The worry is that this consensus seems to have come and established itself very quickly, which should give us a pause for reflection.

If inflation remains lower than expected and/or the Fed remains firmly attached to its current policy environment, the presumptions of recent weeks are starting to appear very misplaced – something without high volatility that is unlikely to happen.

Cluster Cluster

The unlikely increase in GameStop’s revenge (and volatility) has kept up since Reddit traders declared it as their meme choice stock in January, as they ploughed into the most heavily cut corporations on Wall Street. In the last decade, GameStop has particularly suffered from the plight of brick and mortar retailers.

The wiping of almost 90% of the share gains as computer gaming and independent companies like Minecraft have flooded the market share until the end of 2019. In April 2019, current CEO of George Sherman joined the company, but the stock of GameStop began to grow at the back of last year when Cohen, aged 35, started to buy shares in order to “lack the thinking, resources and plan required to make [a GameStop] a dominant player for the sector.” Cohen’s increasing stake helped him to gain seats on GameStop’s board in January, and a few of his Chewy colleagues were burning the bullishness among Reddit traders who expected to reverse.

Also Read: Calculations for Fusion Reactors are now easier. AI Is All The Way Together

The Entrepreneurs Diaries is now available on Telegram. Join our telegram channel to get instant updates from TED.