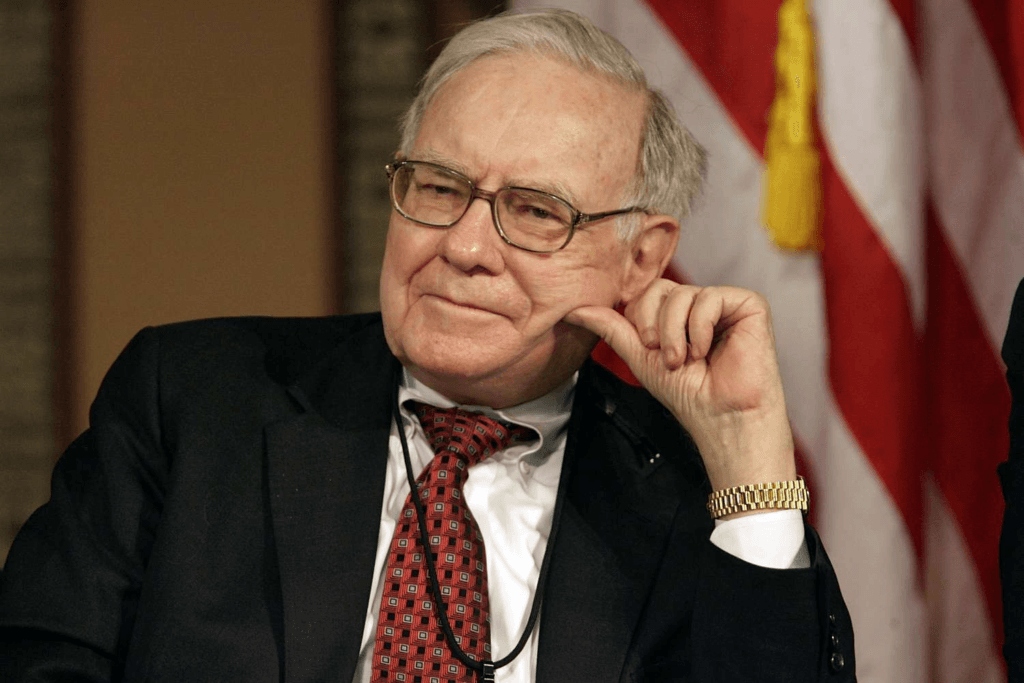

Diageo | Warren Buffett, synonymous with investment success, continues to lead the financial world with his unmatched strategies and timeless wisdom. As Berkshire Hathaway’s (NYSE: BRK.A) Chairman and CEO, Buffett’s recent moves offer valuable insights into navigating the ever-changing markets of 2025. From bolstering cash reserves to new stock acquisitions, Buffett’s approach reveals his meticulous planning and foresight.

Moreover, Buffett’s philanthropic commitment is equally inspiring. His fortune, estimated at $140 billion, is set to fund a charitable trust administered by his three children, with a unique decision-making structure ensuring unanimity in all disbursements.

This article delves into Buffett’s latest financial strategies, new stock picks, and the lessons they offer for investors.

Warren Buffett’s investment strategy for 2025

Berkshire Hathaway’s Financial Strategy

Record-Breaking Cash Reserves

- Berkshire Hathaway has amassed $277 billion in cash, cash equivalents, and short-term investments, marking the highest cash reserve in its history.

- The slowdown in stock buybacks, with none occurring in Q3 2024, signals a strategic shift.

Market Outlook and Speculation

- Analysts speculate that Buffett anticipates a market downturn, positioning Berkshire to capitalize on undervalued stocks.

- Buffett’s comments at the annual shareholder meeting also highlight potential tax implications, with capital gains taxes likely to increase in the future.

Portfolio Snapshot

- Berkshire’s portfolio comprises 40 long-term holdings, including iconic names like The Coca-Cola Co (NYSE: KO) and Kraft Heinz Co (NASDAQ: KHC).

- Despite minimal quarterly changes, Buffett’s occasional new acquisitions reflect his continued commitment to value investing.

Diageo plc (NYSE: DEO): A New Addition

Overview

In Q1 2023, Buffett added Diageo plc (NYSE: DEO) to Berkshire’s portfolio. Known for its world-class brands like Johnnie Walker and Guinness, Diageo’s appeal lies in its strong market position and consistent financial performance.

Strengths

- Revenue: Over $20 billion annually for the past two years.

- Dividend Growth: A steady increase for over three decades.

- Cash Flow: Robust free cash flow of $2.60 billion.

Challenges

- Debt: Diageo’s debt stands at $22.11 billion, though manageable given its cash flow.

- Market Conditions: Declining volumes due to inflation and weaker consumer spending.

Why Buffett Invested

Buffett’s investment in Diageo reflects his preference for consumer staples with resilient business models, even during challenging economic periods.

Comparing Traditional Investments with AI Stocks

While Buffett’s strategy emphasizes stability and long-term growth, the rise of AI stocks presents compelling opportunities for higher returns within shorter timeframes. Investors seeking alternatives may consider:

- Cheaper AI Stocks: Companies trading at less than five times earnings.

- Growth Potential: AI-driven innovations in healthcare, automation, and data analytics.

Philanthropy and Legacy

Buffett’s $140 billion fortune will fund a charitable trust requiring unanimous consent from his three children for any disbursement. This structure ensures collaboration and aligns with Buffett’s value-driven philosophy.

In his own words:

“That restriction enables an immediate and final reply to grant-seekers: ‘It’s not something that would ever receive my brother’s consent.’ And that answer will improve the lives of my children.”

Warren Buffett’s investment strategy for 2025 highlights his enduring commitment to value investing, careful market analysis, and financial prudence. With a record-breaking cash reserve, new acquisitions like Diageo, and a focus on philanthropy, Buffett’s approach continues to inspire investors worldwide.

Whether you’re drawn to traditional consumer staples or intrigued by emerging opportunities in AI, Buffett’s strategies underscore the importance of foresight, patience, and adaptability in navigating the complexities of the financial markets.

Connect With Us On Social Media [ Facebook | Instagram | Twitter | LinkedIn ] To Get Real-Time Updates On The Market. Entrepreneurs Diaries Is Now Available On Telegram. Join Our Telegram Channel To Get Instant Updates.

Jason Foodman is a well-known entrepreneur and executive with experience operating companies globally and launching global companies in the U.S. market. Mr. Foodman started, scaled, and sold several notable technology firms, including SwiftCD and FastSpring.