Trump’s Tax Returns Reflect A Larger American Issue.

We’ve known for a long time about some basic facts about Donald Trump as a businessman, thanks to the Times and other reliable news sources. He makes extravagant claims regarding his wealth. Even though he says he is a good CEO, the businesses he is in charge of, especially his golf resorts, always lose a lot of money. In addition, he pays a modest amount of federal income tax, like many other wealthy Americans.

Tuesday’s release of Trump’s tax returns for 2015-2020 by the House Ways and Means Committee supports this conclusion. The committee has not yet released the former president’s complete tax returns, but plans to do so in the coming days. According to the provided summary tables, Trump paid $1,100,000 in federal income taxes during his four years as president. In his final year as president, he made no payments in 2020.

Trump has a licensing business and ownership stakes in two prime office buildings in New York and San Francisco, both of which are managed by a third party (Vornado Realty Trust), which makes his ability to avoid paying taxes even more remarkable. You must wait for the final numbers to determine how he did it. Nonetheless, the committee’s summary data suggests that he used the same tax-cutting strategies he’s used for decades, such as taking suspiciously large deductions for real-estate depreciation, charitable contributions, and carryovers of previous losses; and being a truly terrible businessman who overpays for many of his properties, burdening them with large debts that consume a significant portion of their revenues. (According to an investigation by the 2020 Times, Trump’s renowned golf resorts lost over $300 million between 2000 and 2017).

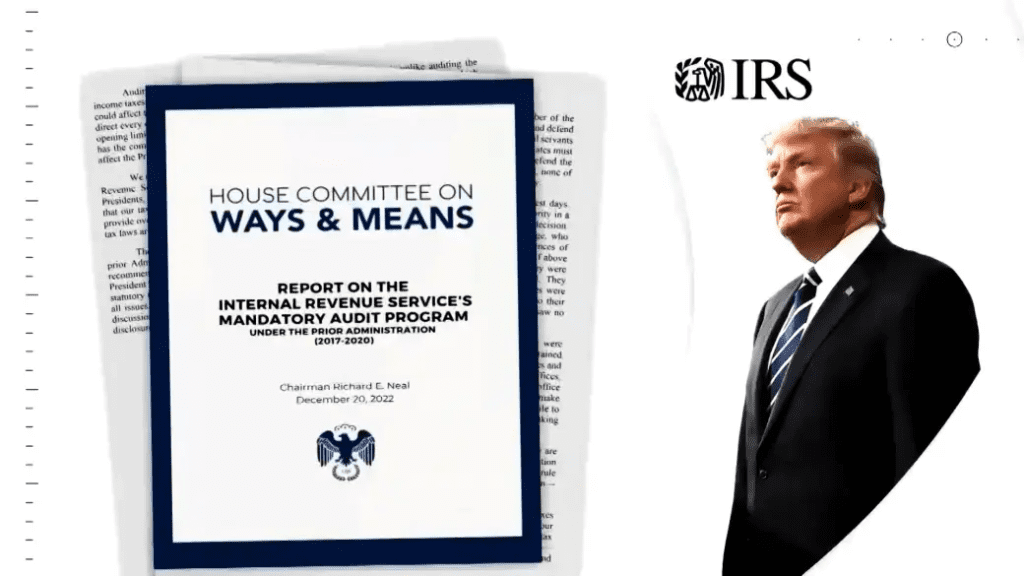

Trump’s tax returns have been the subject of a protracted legal battle, which the report of the committee concludes. The second major takeaway is not revolutionary, but it is crucial. When dealing with wealthy and aggressive financial operators like Trump, whose annual tax returns can include figures from hundreds of business entities and who employ expensive accountants and attorneys to prepare their returns, the IRS frequently feels outmatched and defensive. This is why Democrats passed the Inflation Reduction Act this summer, which authorized a substantial increase in IRS audit funding for the wealthiest taxpayers.

Reports from the House Ways and Means Committee and the Joint Committee on Taxation, which both examined Trump’s tax returns, confirm that the IRS and the former president have been at odds for a considerable amount of time. An IRS agent examining the former president’s 2016 tax returns filed in 2017 discovered “complex issues being worked concurrently for tax years 2009 through 2013.” This was required by a policy mandating audits of sitting presidents. As of 2015, Trump’s legal obligations “have not been settled,” according to the report.

In response to a request for information from Richard Neal, chairman of the House Ways and Means Committee, the Internal Revenue Service (IRS) has delayed the start of required audits until April 2019. One Internal Revenue Service examiner was reportedly responsible for validating the information from hundreds of Trump partnerships and affiliates, whose profits and losses Trump reported on his personal 1040s. With over 400 flow-through returns reported on Form 1040, it is not possible to obtain the resources necessary to examine all potential issues, according to an internal IRS memo cited in the committee report.

Instead of verifying each of Trump’s numerous deductions, such as charitable deductions for land easements and loans to his children, the IRS examiner appears to have relied on the fact that the returns were prepared by professional accountants and attorneys, assuming that they ensured the information from Trump and his businesses was accurate. Analysts of the Joint Committee stated, “We… do not understand why the participation of legal counsel and an accounting firm in tax return preparation guarantees their accuracy.” With the recent conviction of the Trump Organization for tax fraud and falsifying company accounts in a case brought by New York prosecutors, there is reason to be skeptical of anything involving Trump’s finances. Mazars, his former accounting firm, claimed ignorance of the events that led to his conviction, including the practice of providing executives with company-funded apartments, car leases, and other personal benefits that they did not report to tax authorities.

In Trump’s tax returns, the Joint Committee on Taxation discovered several troubling items, including his use of a private jet for business, payment of a cash settlement to settle a lawsuit against Trump University, and practice of making cash charitable donations. The Joint Committee investigated Trump’s business expenses and loans to his children, believing they were “masquerading as gifts.” According to the Committee’s findings, “personal expenditures improperly deducted as business expenses” are a common occurrence in audits of closely held businesses.

When the IRS decided to examine Trump’s 2017 and 2018 tax returns, it increased the number of examiners from one to three. This appears to have angered Trump’s high-priced attorneys, with whom he had a regular contract. According to the report, “the former President’s representatives were concerned about the team size of revenue agents, stating that ‘the team size increased by 300 percent’,” citing an Internal Revenue Service document (i.e., from one to three). The former IRS Chief Counsel and international law firm partners were among those seen representing the former president.

This is the crux of the IRS’s problem when attempting to collect taxes from the wealthy, who often have the resources, the time, and the will to fight them tooth and nail. Trump is notable for his consistently low tax payments, extensive tax avoidance strategies, and willingness to discuss his ability to exploit the tax system in public. However, this issue goes far beyond that. Republicans are committed to reversing the progress made by Congress by allocating an additional $79 billion to the IRS over the next decade to increase its examinations of high-income taxpayers with complex returns. In the omnibus spending agreement reached this week, the Republicans were able to cut a portion of the new IRS funding, and they have vowed to eliminate it entirely once they assume control of the House in January. If bipartisan support is not provided, the Internal Revenue Service will forever be on the defensive.

Connect With Us On Social Media [ Facebook | Instagram | Twitter | LinkedIn ] To Get Real-Time Updates On The Market. Entrepreneurs Diaries Is Now Available On Telegram. Join Our Telegram Channel To Get Instant Updates.