Financial planning tips for entrepreneurs are more vital than ever in 2025, a year filled with dynamic opportunities and challenges. Entrepreneurs, whether new to the field or seasoned professionals, often face complex financial landscapes. Without proper planning, it’s easy to fall into pitfalls like cash flow mismanagement or excessive debt.

- Top Financial Planning Tips for Entrepreneurs in 2025

- 1. Set Clear Financial Goals

- 2. Develop a Realistic Budget

- 3. Separate Personal and Business Finances

- 4. Build an Emergency Fund

- 5. Monitor Your Cash Flow

- 6. Leverage Technology for Financial Management

- 7. Invest Wisely in Growth Opportunities

- 8. Seek Professional Financial Advice

- 9. Stay Updated on Tax Regulations

- 10. Plan for Retirement

This article explores 10 actionable financial planning tips for entrepreneurs that will not only protect their business but also ensure long-term sustainability and growth. These tips cover goal-setting, budgeting, investing, and more. Let’s dive in and set the foundation for financial success.

Top Financial Planning Tips for Entrepreneurs in 2025

1. Set Clear Financial Goals

Every entrepreneurial journey begins with a vision. Financial planning tips for entrepreneurs emphasize setting specific, measurable, and realistic goals.

- Short-term goals: Pay off outstanding debts or increase monthly revenue.

- Long-term goals: Expand to new markets, build emergency funds, or secure funding for larger projects.

Having defined financial goals not only keeps you motivated but also helps track your progress effectively.

2. Develop a Realistic Budget

Budgeting forms the backbone of financial planning tips for entrepreneurs. A clear and realistic budget provides insights into spending habits and identifies areas where you can cut costs.

Steps to create a budget:

- Track income: Know your monthly revenue streams.

- Identify expenses: Categorize fixed and variable expenses.

- Adjust allocations: Redirect savings towards growth opportunities.

Remember, a good budget evolves with your business. Regularly review and revise it based on your current financial standing.

3. Separate Personal and Business Finances

One of the most overlooked financial planning tips for entrepreneurs is separating personal and business finances. Combining these can lead to confusion, mismanagement, and even legal complications.

Why it’s crucial:

- Simplifies tax filing.

- Provides accurate financial reports.

- Reduces the risk of overspending on personal needs using business funds.

Open a separate bank account for your business and use tools like accounting software to maintain transparency.

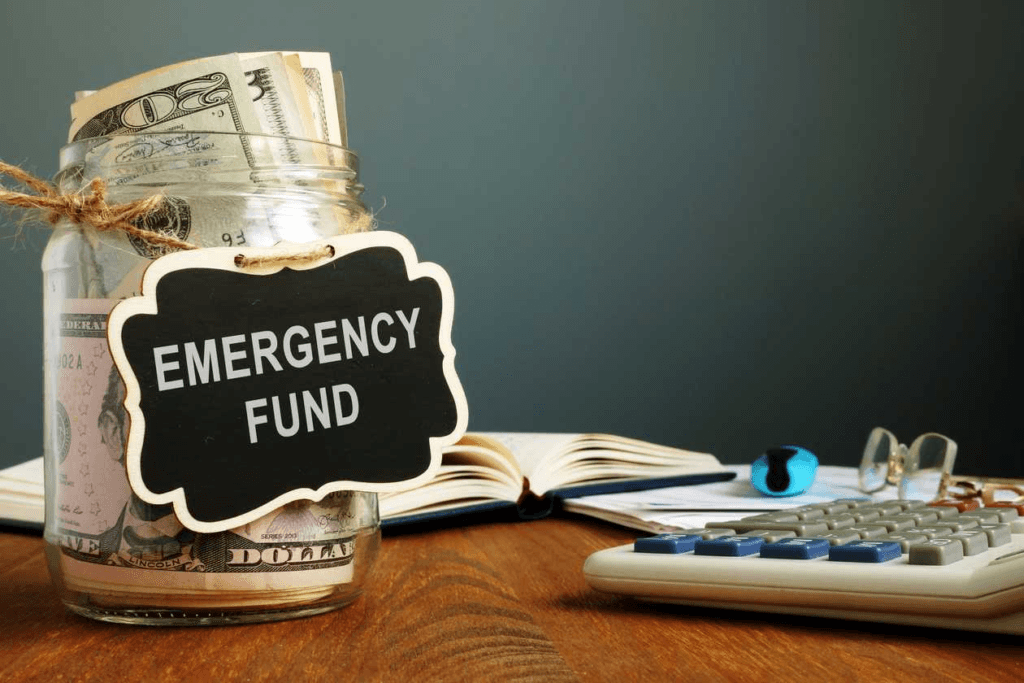

4. Build an Emergency Fund

Financial stability requires preparation for the unexpected. An emergency fund acts as a financial cushion during challenging times, such as market downturns or unforeseen expenses.

How to build it:

- Save a portion of your monthly revenue.

- Automate transfers to a dedicated emergency fund account.

- Aim for 3–6 months’ worth of operating expenses.

Emergency funds empower entrepreneurs to navigate uncertainties without jeopardizing their business.

5. Monitor Your Cash Flow

Cash flow is the lifeblood of any business. Regularly monitoring and managing your cash flow is among the most critical financial planning tips for entrepreneurs.

Best practices for cash flow management:

- Track receivables and payables: Ensure timely payments from clients while meeting your obligations.

- Avoid overextending credit: Offer credit terms cautiously to avoid cash shortages.

- Use cash flow forecasting tools: Predict future financial scenarios to make informed decisions.

Healthy cash flow ensures your business stays operational and scalable.

6. Leverage Technology for Financial Management

In 2025, financial planning tips for entrepreneurs include embracing technology to streamline processes.

Recommended tools:

- QuickBooks: For bookkeeping and tax preparation.

- Wave: Ideal for small businesses managing invoices and expenses.

- Mint: Tracks budgets and savings goals.

Technology reduces manual errors, saves time, and enhances efficiency in managing finances.

7. Invest Wisely in Growth Opportunities

Investments are a double-edged sword, but calculated risks can propel your business forward. Financial planning tips for entrepreneurs recommend strategic investments that align with your goals.

Examples of wise investments:

- Digital marketing campaigns: Increase visibility and attract customers.

- Upgrading technology: Improve efficiency and stay competitive.

- Employee training: Foster talent that drives innovation.

Analyze potential returns on investment (ROI) and avoid impulsive spending.

8. Seek Professional Financial Advice

While entrepreneurs often wear multiple hats, financial planning is an area where professional advice can be invaluable. Consulting financial advisors, accountants, or wealth managers can save you from costly mistakes.

What to expect from a financial advisor:

- Tax optimization strategies.

- Investment portfolio management.

- Risk assessment and mitigation.

Seeking advice early can set you on the path to sustained financial health.

9. Stay Updated on Tax Regulations

Tax compliance is a non-negotiable aspect of financial planning tips for entrepreneurs. Missteps in tax filing can result in penalties, audits, or reputational damage.

Key actions to stay compliant:

- Keep accurate records: Organize receipts, invoices, and financial statements.

- Use tax software: Automate calculations and filing.

- Hire a tax professional: Ensure deductions and credits are maximized legally.

Regularly check updates in tax laws to remain compliant and capitalize on opportunities.

10. Plan for Retirement

Finally, financial planning tips for entrepreneurs aren’t complete without addressing retirement. While building a business is fulfilling, planning for the future ensures you enjoy the fruits of your labor.

Retirement planning strategies:

- Contribute to retirement accounts like IRAs or 401(k)s.

- Diversify investments for long-term growth.

- Create a succession plan for your business.

Early retirement planning provides financial security and peace of mind.

Start Planning Today for a Profitable Future

Implementing these financial planning tips for entrepreneurs in 2025 can transform your business and personal finances. From setting goals to leveraging technology, each step lays the groundwork for stability and growth.

Remember, the earlier you start, the better prepared you’ll be to face challenges and seize opportunities. Take the first step today, and secure your entrepreneurial journey with a solid financial foundation.

Connect With Us On Social Media [ Facebook | Instagram | Twitter | LinkedIn ] To Get Real-Time Updates On The Market. Entrepreneurs Diaries Is Now Available On Telegram. Join Our Telegram Channel To Get Instant Updates.

Jason Foodman is a well-known entrepreneur and executive with experience operating companies globally and launching global companies in the U.S. market. Mr. Foodman started, scaled, and sold several notable technology firms, including SwiftCD and FastSpring.