DeFi-Changing Financial Institutions

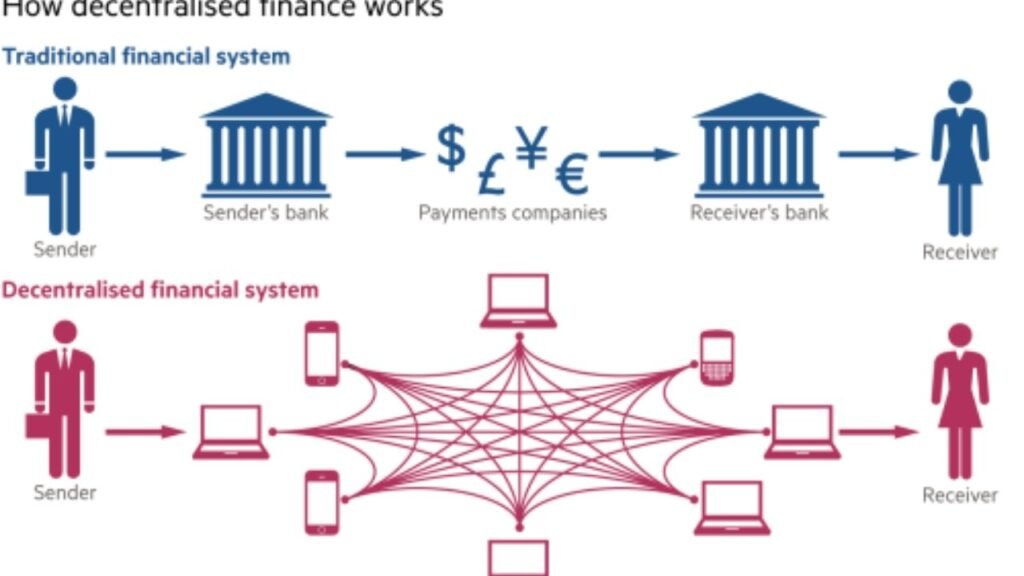

DeFi can also additionally have a critical effect on how banks perform withinside the destiny and has the ability to extrude the shape of monetary structures on the macroeconomic level. DeFi is an umbrella time period for a monetary machine that capabilities without intermediaries consisting of banks, insurances, or clearinghouses. It is operated totally via way of means of the electricity of clever contracts. DeFi packages serve the position of conventional finance (CeFi) in an everyday and obvious manner.

The concept of a brand new monetary machine is part of the blockchain area and has been because of its inception. Since 2020, DeFi has been developing at a speedy tempo and today, billions of USD had been placed into the ecosystem. The boom is predominantly led via way of means of applications (protocols) constructed at the Ethereum blockchain.

Commercial Banks

The number one commercial enterprise version of industrial banks is to simply accept deposits and deliver loans to clients. Borrowing and lending shape the cornerstone of powerful monetary structures for the reason that holders of the price range get hold of an incentive to offer liquidity to the markets. In change, they earn a go back on a property that could in any other case be unproductive. DeFi protocols serve to permit unknown contributors to each lend and borrow sources on a much wider scale without related to intermediaries.

These programs deliver creditors and debtors collectively and decide hobby fees robotically consistent with delivery and demand. Anyone can have interaction with those protocols at any time no matter the place or amount. The current hype around DeFi apps is pushed through the increase of lending and borrowing protocols. By contrast, conventional finance loans in DeFi are normally secured through over-collateralization. Companies along with Aave are operating on allowing uncollateralized loans akin to conventional finance.

Investment Banks And Issuers Of Monetary Instruments

The enterprise version of funding banks commonly entails the advisory on economic transactions. The buying and selling or developing of complicated economic merchandise and control of property fall into the world of funding banks. DeFi protocols provide comparable merchandise. For example, Synthetix is a by-product issuance protocol, which permits decentralized introduction and buying and selling of derivatives on the property along with stocks, currencies, and commodities. The decentralized asset control for cryptocurrency is evolving. As an example, Yearn Finance is a self-sufficient protocol and searches for his or her satisfactory yields withinside the DeFi area even as concurrently making an investment for its users.

Exchanges

Exchanges serve to prepare the buying and selling of various assets. These encompass shares or overseas currencies that exist among or greater marketplace participants. The change of crypto-forex in opposition to fiat money (as an instance American dollar) may be credited to CeFi. Regular holders of cryptocurrencies ought to use exchanges like Binance or Coinbase (centralized organizations) to change a unit of cryptocurrency in opposition to another.

With the brand new emergence of decentralized exchanges (DEX), holders of crypto do not want to go away to the crypto area to change their tokens. One high instance of a DEX is Uniswap. DEX is compiled of clever contracts that preserve liquidity reserves and characteristics in step with described pricing mechanisms. The computerized liquidity protocols play a critical position in growing an unbiased decentralized environment with no CeFi intermediaries.

Insurances

The maximum vital characteristic of coverage is to clean out dangers and produce protection for marketplace individuals. For example, one version of decentralized coverage is Nexus Mutual. This gives insurances that cowl insects in clever contracts. Everything primarily based totally on clever contracts in DeFi—specifically the publicity withinside the code of clever contracts—-creates a better danger for DeFi users. Decentralized insurances are nevertheless in starting place stages. It is predicted that large and greater state-of-the-art coverage fashions have the capacity to emerge withinside the DeFi space.

Central Banks

Stablecoins are primarily based totally on blockchain protocols which have the precept of charge balance encoded so that they satisfy the characteristic of a reserve currency. The advent of stablecoins set the inspiration for the functioning decentralized economic system. It permits individuals to interact with every different without the underlying danger of charge volatility.

There are 3 alternatives for the way crypto can attain fee balance:

- Stablecoins can attain excessive stages of fee balance through pegging a foreign money to different assets. For example, for every issued unit of USD coin, a actual US greenback is held in reserve.

- DeFi perspective: some other thrilling technique is the issuance of stablecoins through the use of different crypto as collateral. The significant protocol for the DeFi surroundings is Maker DAO. The crypto DAI is sponsored through different cryptos and guarantees with its set of rules that the cost of one DAI is round 1 US Dollar.

- The experimental technique goals to attain fee balance with out use of collaterals. For example, protocol Ampleforth mechanically adjusts the deliver of token according with demand.

How Nimbus May Combine Itself With Banking

Nimbus is a DAO-ruled atmosphere of dApps that gives sixteen sales streams for customers primarily based totally on IPO participation, lending, crypto-buying and selling, and extra. So some distance Nimbus has 50,000 customers and maintains to grow. The key services to Nimbus stakeholders are that it has sixteen incomes techniques for customers in a single platform. It has specific get admission to IPOs, startup financing, and different opportunities, now to be had in crypto. So some distance it has tokens presenting get admission to it all: NBU and GNBU. Nimbus may want to combine similarly with banking because it maintains to extend its consumer base. With plenty to provide its stakeholders along with unique get admission to its IPO offering, there are numerous incentives for customers and stakeholders to enroll in Nimbus and grow to be similarly integrated. As crypto buying and selling turn into extra famous as sales circulate for customers, Nimbus will keep growing to be similarly entwined with the banking enterprise as a for-earnings entity. With alternatives to lend, borrow and exchange for crypto customers, Nimbus is swiftly increasing its consumer base and could in all likelihood see an exponential increase withinside the coming future. One aspect is for sure, Nimbus will keep combining similarly because the atmosphere expands and develops.

Written by Kusuma Nara |The Entrepreneurs Diaries is now available on Telegram. Join our telegram channel to get instant updates from TED.