Your credit score rating holds lots of energy in terms of engaging in life’s large milestones, including shopping for a brand new automobile or taking away a loan for your first home. Lenders depend on lots on your credit score rating whilst determining whether or not to approve you for a brand new monetary product. After all, it really works as a key element for banks and monetary establishments even as presenting you with a mortgage or a credit scorecard.

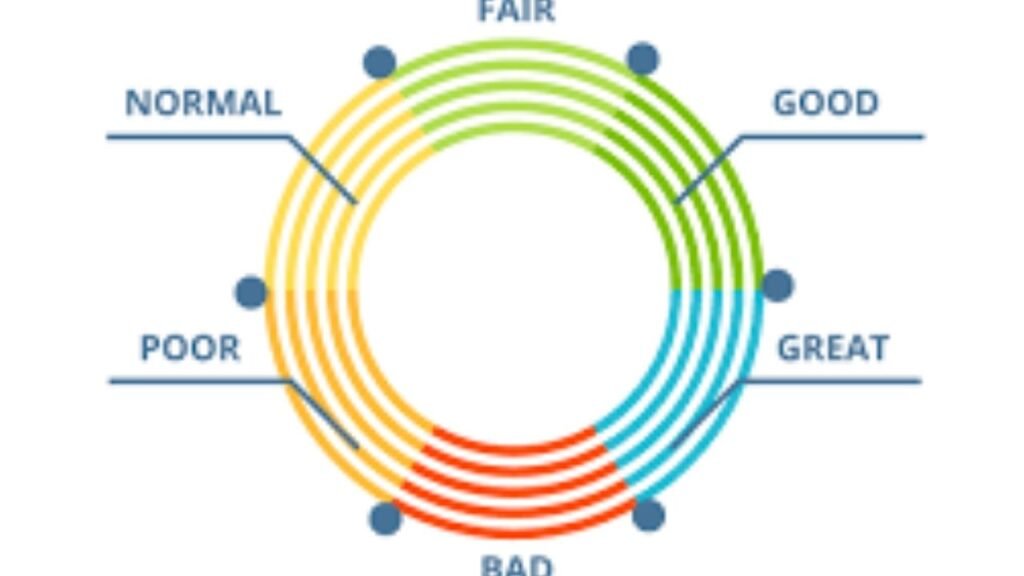

A credit score rating is a three-digit numeric quantity starting from three hundred to 900, and it’s far assigned to each man or woman who has availed of a credit score product, primarily based totally on his or her credit score/mortgage conduct over the period. In India, credit score records are maintained via way of means of credit score bureaus which might be certified via way of means of RBI. Currently, there are four credit score bureaus in India, and they’re TU CIBIL, Experian, Equifax, and CRIF Highmark. Each of those credit score bureaus has its personal set of rules to assign a credit score rating to each man or woman.

The rating is generated primarily based totally on an individual’s credit score reimbursement conduct over a length of time. All folks want to keep a wholesome credit score rating because it determines our borrowing capability. Keep in thoughts that it is now no longer simply potential creditors that use credit score ratings however even present creditors additionally preserve searching at your reimbursement and borrowing conduct and decide whether or not to keep with credit score facility or improve or downgrade the credit score facility or product. Increasingly, coverage agencies are the use of credit score ratings as one predictor, now no longer best of on-time payments, however additionally of an individual’s universal monetary conduct that will increase their degree of risk. Other monetary establishments and employers also are checking credit score ratings to display out unwanted applicants.

Easy Hints To Enhance Your Credit Score

Paying mortgage EMIs/credit score card payments on time: Your fee history—whether or not or now no longer you pay your payments on time—has the largest effect on your credit score score. It’s additionally something that creditors pay near interest to after they pull your credit score record earlier than approving you for a mortgage or new credit scorecard.

Never pay simply the minimal quantity due on credit score card payments: In general, you need to make fee of your credit score card payments both incomplete or as a minimum pay greater than the minimum due quantity. Paying the minimal due quantity on credit score card payments reduces your danger to enhance your credit score score.

Avoid needless inquiries for mortgage/credit score cards: Multiple credit score inquiries inside a brief span of time from ability lenders solicited or unsolicited, can simply decrease your rating. This consists of inquiry from loan groups each time you get a pre-approval on a domestic mortgage and inquiry for a credit score card at branch shops that provide you a ten in keeping with cent bargain or making use of for unsolicited credit scorecard gives you get hold of withinside the mail. One must keep away from making a utility for mortgage/credit score card till necessary.

Maintain credit score card restriction usage beneath 60-70 in keeping with cent: Avoid using your credit score card restriction to its fullest, because it affects credit score rating negatively. If you manifest to make use of the restriction completely, you must make certain that the price is executed in full/element to convey the restriction usage right all the way down to 60-70 in keeping with cent.

Good blend of credit score product: Always keep a great blend of each secured (domestic loan/car loan/two-wheeler loan, etc.) and unsecured (non-public loan/credit scorecard/customer durable, etc.) loans. A proper blend improves the possibility of getting a higher credit score rating. Although, having too many unsecured loans have to now no longer be preferred.

Review your credit score file regularly: One has to take a look at his/her credit score file for any incorrect reporting accomplished through any lender withinside the credit score file. If in case, there may be any discrepancy withinside the loan/credit score tradelines then you may enhance the dispute to the credit score bureau or the lender immediately and get the issue(s) resolved. This exercise enables withinside the development of your bureau rating. It is usually advocated to test your credit score rating properly earlier as there may be no manner you may accurate the file on the final minute.

Also, display loans in which you’re co-borrower or guarantor: In case you’re co-applicant or guarantor for any mortgage in which you aren’t a number one borrower, you must display reimbursement conduct of those loans in addition to they’ll additionally affect your credit score score.

Good credit score control results in better credit score scores, which in flip lowers your fee to borrow. Living inside your means, the usage of debt accurately, and paying all bills—which includes credit score card minimal payments—on time, each time are clever monetary moves. They assist enhance your credit score score, lessen the quantity you pay for the cash you borrow and placed extra cash in your pocket to store and invest.

Written by Kusuma Nara |The Entrepreneurs Diaries is now available on Telegram. Join our telegram channel to get instant updates from TED.